Meet Benoit, a passionate entrepreneur with a vision to revolutionize urban transportation. Armed with an idea for a new electric scooter, a small dedicated team, and a prototype that turns heads, Benoit dreams of changing the way people move through cities. On paper, the company doesn’t seem like much substantial assets, no significant revenue-but when venture capitalists (VCs) start talking numbers, they mention valuations in the millions. How can that be?

A cake that you can’t taste

Imagine holding a delicious piece of cake that’s frozen solid. You know it’s valuable and will be delightful, but you can’t enjoy it just yet. That’s what a startup’s valuation is like-it’s worth something significant “on paper”, but you can’t cash it out immediately to buy your new Jaguar.

The supermarket Price Tag

When Benoit embarks on the journey to secure funding, one of the first challenges is figuring out the price tag of the startup. You’re a new product on a supermarket shelf: What makes a customer in this case, a VC-pick you up? To understand this, let’s dive into why startups like Alex’s seek funding at first and how the fundraising process unfolds.

Why Do Startups Fundraise?

Startups need capital to transform innovative ideas into reality. For Benoit, that means financing research and development, manufacturing prototypes, and eventually scaling up production. Early-stage startups often aren’t profitable; they might not even have revenue. Yet, expenses like salaries, equipment, and marketing can’t wait. They need cash - the fuel that powers their journey towards success.

The fundraising Journey

Benoit begins by gathering all the data that could persuade VCs to invest: market research, growth projection, and a compelling pitch deck. Meetings are set, and the storytelling begins. Alex paints a picture of a future where his electric scooters are an integral part of urban life.

If a VC sees the spark and believes in the vision, they offer a term sheet. This document is like a roadmap for the investment, outlining the valuation, ownership stakes, and other essential terms. Valuation sits at the heart of this agreement and determines how much of the company Benoit will exchange for the capital needed to grow.

Deciphering valuation: Pre-money vs Post-money

VCs often speak in terms of pre-money and post-money valuations. Think of pre-money valuation as the value of Benoit’s company before a new investment. Post-money valuation is the sum of the pre-money valuation and the investment itself.

For instance, a VC might say, “We’re offering $1 million at a $5 million post-money valuation.” This means they believe Benoit’s company is worth $4 million at this stage (pre-money) and with their $1 million investment, it will be worth $5 million. This calculation also determines the ownership percentage the VC will receive.

But Benoit wonders, “I have a prototype and a dream - how can my company be worth $5 million?”

The Magic of Potential

Unlike traditional businesses valued by physical assets like buildings, startups are valued based on potential. VCs are betting on what Alex’s company could become, not just what it is today. They consider intangible factors:

Metrics

Founder’s Experience

Market Competition

Industry Trends

Investor demands

Data is king

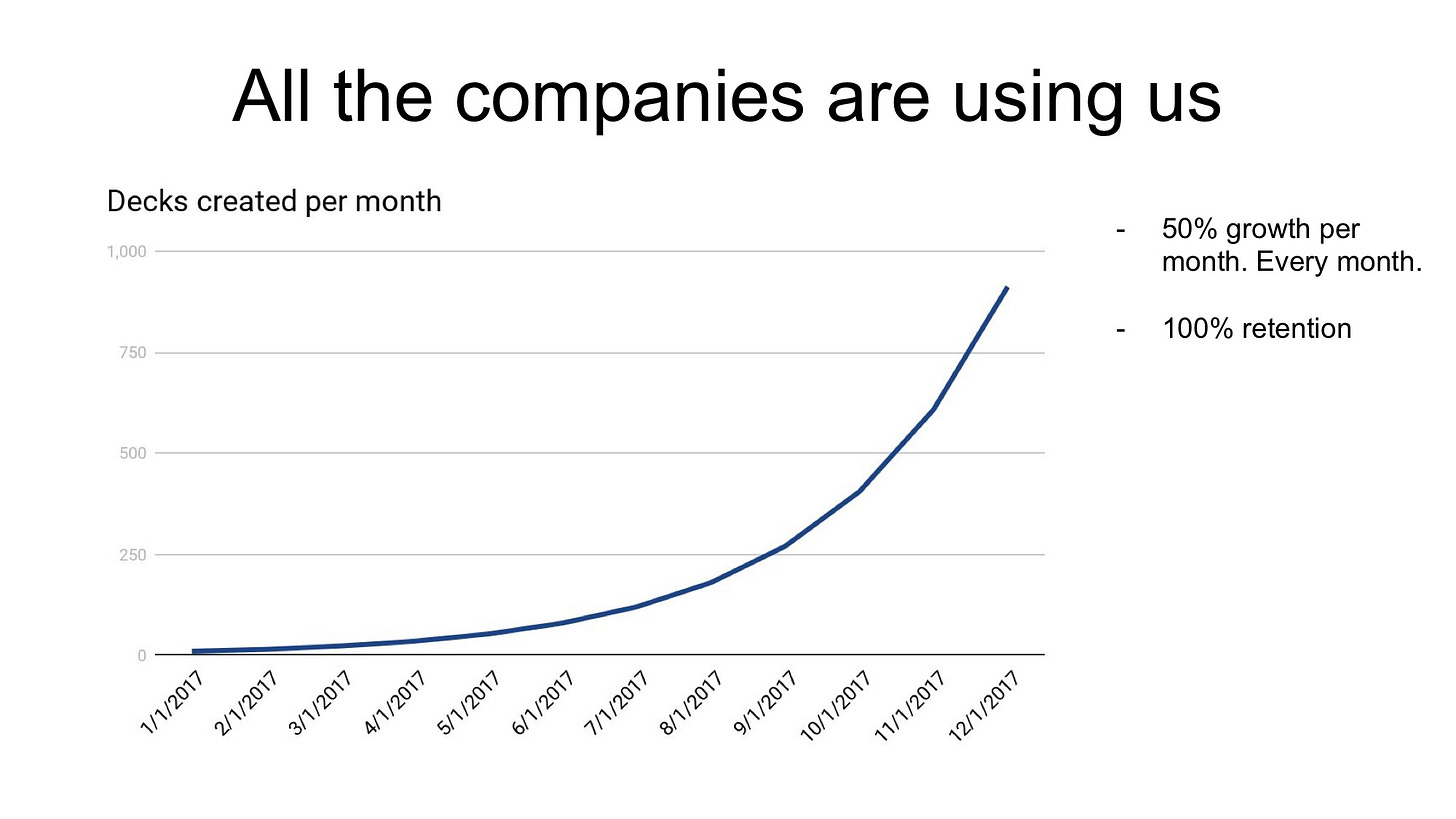

In the meeting, Benoit leans heavily on data. Even if VCs believe in an entrepreneur’s vision, they will mostly put their personal thinking aside to focus on data: metrics, metrics, metrics. For early-stage startups, this includes the number of active users, user retention, and most importantly, your growth rate. Metrics measure the traction of your idea-do people want your product or service?

Ideally, your growth should look like this

Of course, course growth is rarely a smooth exponential curve, but the idea is to show momentum growth akin to a spreading virus.

For later-stage startups, the focus shifts to revenue (Annual Recurring Revenue or ARR) and of course growth rate. Each sector has valuation benchmarks, often using a multiple of revenue. VCs compare startups with market averages to establish a benchmark.

*NTM revenue refers to a company’s revenue over the next twelve months (NTM) of operations.

The founder factor

Benoit’s personal journey adds weight to the valuation. Perhaps Benoit previous at a leading tech company of has experience in urban planning. This background reassures VCs that Benoit has the skills and network to navigate challenges.

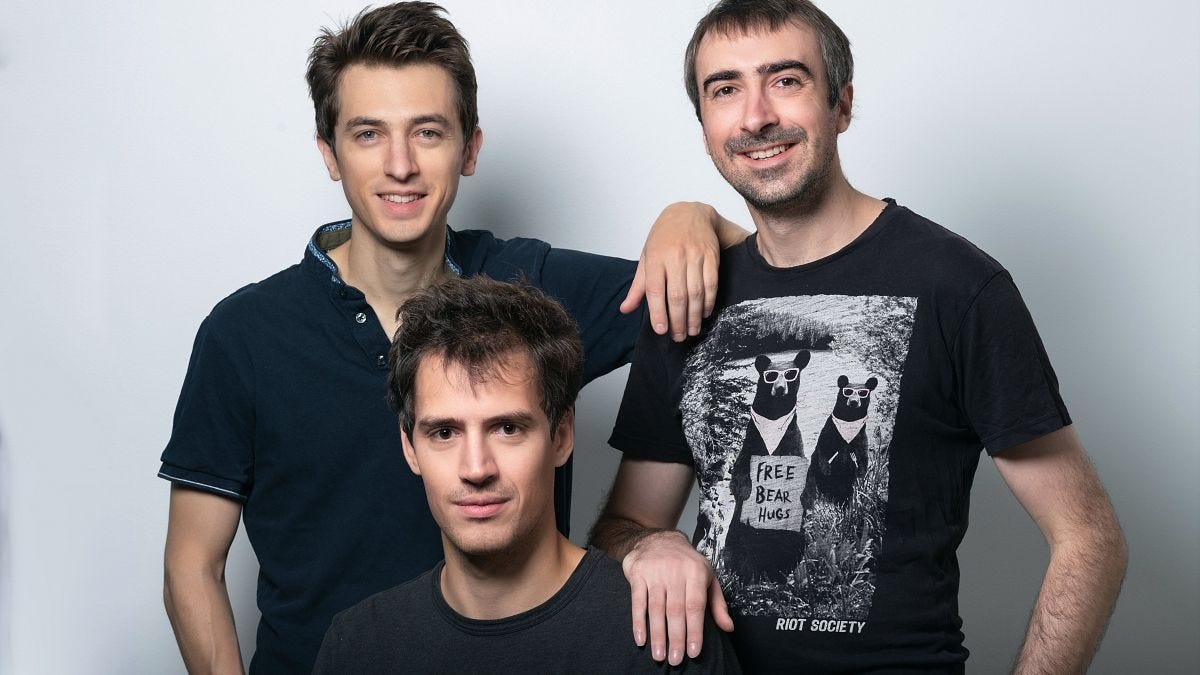

Sometimes, startups can raise crazy amounts based solely on founder experiences. Take the example of Mistral AI, the “French ChatGPT”. They raised over $105 million before even launching their product, achieving a billion-dollar valuation in less than a year. Their secret? They assembled an outstanding team - The “Dream Team” of AI;

Arthur Mensch, ex-Deep-Mind, Google’s AI research lab

Guillaume Lample, ex-Meta, co-creator of LLaMa

Timothée Lacroix, ex-Meta, research scientist

With their background, we know they know their shit. VC were confident in their ability to execute.

Catching the Trend Wave

Timing can amplify a startup’s valuation. if Benoit’s company operates in a booming sector like SaaS or AI, VCs might be more generous. They’re eager to ride the wave of the next big thing.

Sometimes, it’s a matter of supply and demand. The more VCs want to invest in your startup, the more they’re willing to pay to secure a piece of the cake - especially if another fund has already extended a term sheet. VCs follow momentum, which can sometimes lead them too far (aka WeWork)

Understanding the Burn Rate

VCs are also keen to understand how quickly the startup will “burn” through the invested capital. Benoit needs to map out monthly expenses and forecast how the funds will drive the company toward key milestones. Typically, VCs look for a runway of about 12 to 18 months before the next funding round is needed.

By calculating this burn rate, Benoit can determine how much money to raise and, by extension, the company’s valuation.

Navigating the fundraising Landscape.

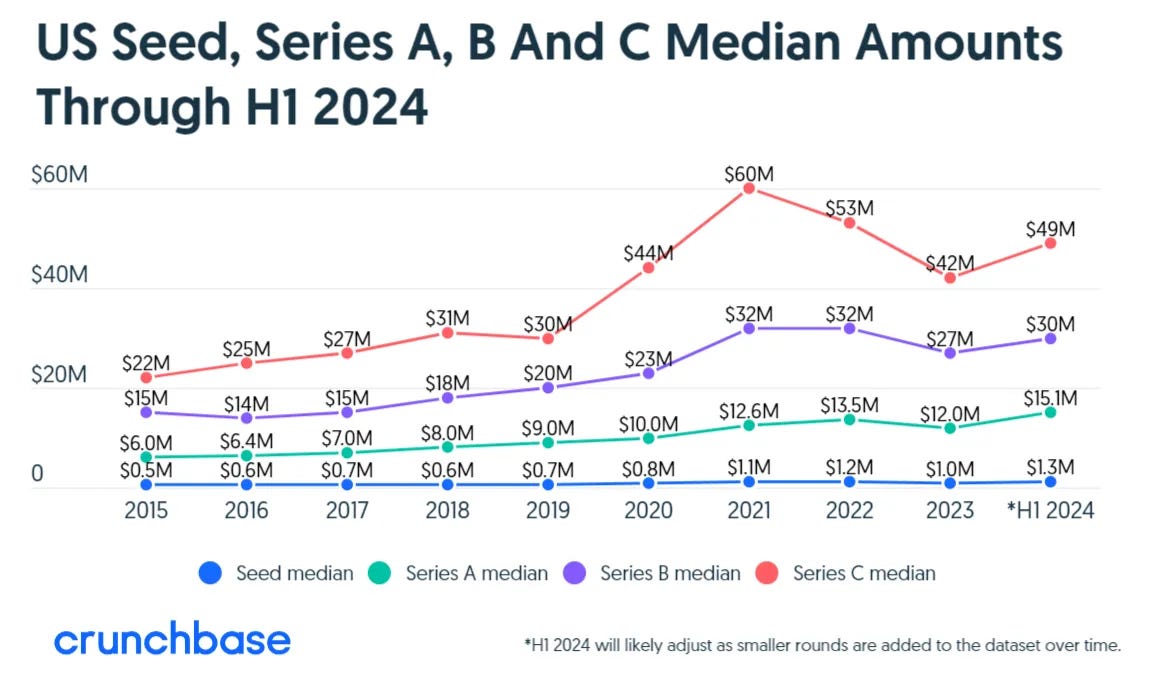

The world of fundraising is ever-changing. In 2021, startups enjoyed a surge of investment, but economic shifts have since made VCs more cautious. Factors like global events, market saturation, and technological advancements can influence how easy or challenging it is to secure funding.

For Alex, staying informed about these trends is essential. Building relationships with investors, adapting to feedback, and demonstrating resilience can make all the difference.

The journey Ahead

Benoit's story shows that a startup's value isn't about what you've got right now but what you can make happen down the road. Valuation is this mix of your vision, the data you've got, timing, and building trust. It's about getting others to see the world you're trying to create with your big idea.

“Value is not measured by what you have today, but by what you can create tomorrow.”